georgia property tax exemptions disabled

The exemption is 50000 off school tax and 15000 off county. 4000 FULTON COUNTY EXEMPTION.

If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your Georgia homes value may be exempt.

. This has no income limit. Applies to all Fulton ad valorem levies in the amount of 4000. Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and.

Must be age 65 on or before January 1. Veterans from 50-69. The value of the property in excess of this exemption remains taxable.

What is the property tax exemption for over 65 in Georgia. 2 loss or permanent loss of use of one or both hands. The additional sum is determined according to an index rate set by United States Secretary of Veterans Affairs.

Property Tax Homestead Exemptions. County Property Tax Facts. To qualify for the Georgia disabled veteran property tax exemption you must be a resident of Georgia and rated 100 percent permanently and totally PT disabled by the VA or be blind or an amputee.

In Texas fully disabled veterans are exempt from all property tax but a veteran with a 70-100 disability rating may only receive 12000 of the assessed value in exemptions. Property Tax Returns and Payment. 1 loss or permanent loss of use of one or both feet.

Applicants may also qualify for this exemption if 100 disabled regardless of age with a signed letter from your doctor stating you are unable to be gainfully employed. However there are no property tax exemptions for disabled non-veteran homeowners. The exemption offers a 1320 reduction of property taxes for veterans who are 100 percent disabled due to service-related incomeinjury.

3 loss of sight in one or both. There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens. This exemption would reduce your school tax by 50.

Tax exemptions for disabled in Georgia. If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year was 10000 or less you qualify for a 4000 property tax exemption.

Homestead Exemption for Disabled Veterans Any qualifying disabled veteran may be granted an exemption of 67555 from paying property taxes for state county municipal and school purposes. There is a household income limit of 10000 Georgia Net Income. To apply for a disabled exemption you will need to bring your Georgia drivers license your Social Security Awards Letter and one Doctors Affidavit completed by your doctor.

If you are 100 disabled but not receiving Social Security for your disability you can still apply for the 50 reduction. Know Your Rights 12 Know Your Rights 12 Know Your Rights Articles 12 13 Item s Found. STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS HF14F 0 Fulton Veterans L2 S5 Disabled veteran or Surviving spouse or children HF14S 0 FULTON VETERANS L2 STATE S5 Disabled veteran or Surviving spouse or children HF14U1 50000 HF14 UE1 S5 Disabled veteran or Surviving spouse or children.

This exemption is for veterans who are verified by VA to be 100 percent totally and permanently service-connected disabled and veterans rated unemployable who are receiving or who are entitled to receive statutory awards from VA for. S enior citizen exemptions. Includes total exemption from all school and school bond tax 10000 off the assessed value on County and 7000 off recreation.

Secretary of Veterans Affairs. Property in excess of this exemption remains taxable. Property Taxes in Georgia.

This exemption is extended to the un-remarried surviving spouse or minor children. It exempts the applicant from all school and state taxes and provides exemption of 101754 for all other levies. The amount of the exemption depends on how much this years assessed value exceeds last years.

6 rows A reduction of 60000 on the assessed value of your home 40 of its market value in most counties. Totally Disabled Code L12 Under Age 65You must be 100 disabled documented by two doctors letters or one doctors letter and Social Security award letter. Any qualifying disabled veteran may be granted an exemption of 50000 plus an additional sum from paying property taxes for county municipal and school purposes.

A letter from the Veterans Administration stating that the veteran has a 100 Service Connected Disability and is totally and permanently disabled is required to. If you are 62 years old or older and your annual family income is 10000 or less up to 10000 of your Georgia homes value may be exempt from school tax. The current amount is 85645.

Senior Citizen Exemptions From Georgia Property Tax. A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate set by the US. And if youre 62 years or older and your family income doesnt exceed 30000 a part of your home may be exempt from.

Property Tax Millage Rates. Your Georgia taxable net income for the preceding taxable year cannot exceed 10000. 8 rows Any Georgia resident can be granted a 2000 exemption from county and school taxes.

This makes the current total property tax exemption 150364 for Georgia disabled veterans. To be eligible for this exemption you must meet the following requirements. S5 - 100896 From Assessed Value.

Disabled veterans who have reached the age of 65 as of January 1st AND meet the requirements for the H5 Disabled Veterans exemption above may be eligible. The only disability property tax exemption in the state is reserved for military veterans.

Property Taxes Calculating State Differences How To Pay

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Fulton County Sends Out Annual Assessment Notices To Milton Homeowners News Milton Ga

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax Retirement Money Retirement Strategies

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

Pdf Land And Property Tax A Policy Guide

City Of Milton Sends Out Annual Property Tax Bills News Milton Ga

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Veteran Tax Exemptions By State

The Ultimate Guide To North Carolina Property Taxes

What Is A Homestead Exemption And How Does It Work Lendingtree

States With Property Tax Exemptions For Veterans R Veterans

Property Overview Cobb Tax Cobb County Tax Commissioner

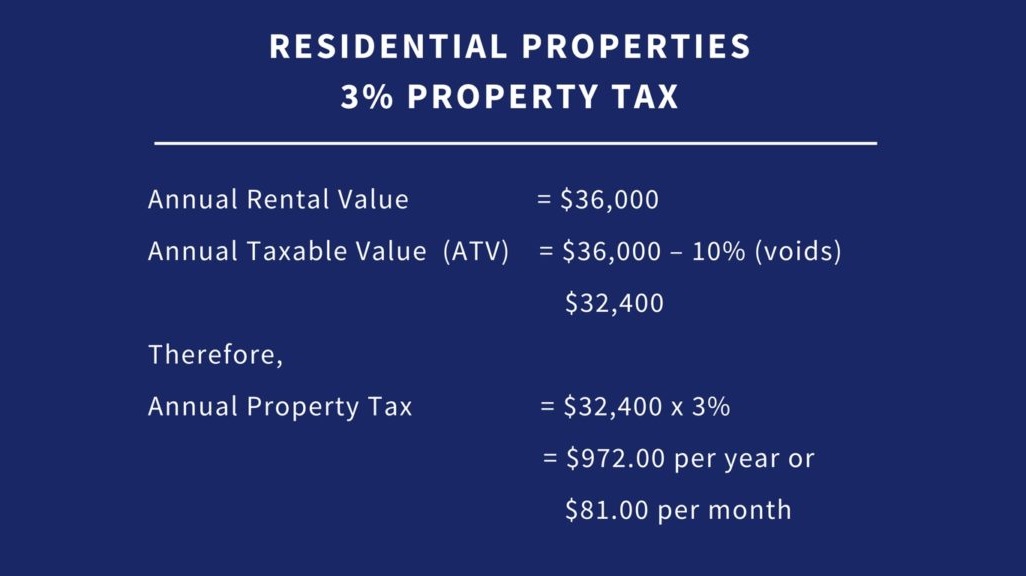

Updated 10 Things To Know About Property Tax Loop Trinidad Tobago

All The Nassau County Property Tax Exemptions You Should Know About